Studies show that the single biggest factor for low participation in 401k plans is the

fear of investing and not having a clear understanding of the

investments in the plan. Thus, we use model portfolios to enable 401k participant education to focus on saving as opposed to investing.

In the Revolt plan, model portfolios are managed by our independent investment advisor. All the employee has to do is select the “bucket” that’s right for him. He is taught to be a saver, not forced to become an investor. He answers a simple risk questionnaire to discern his risk tolerance – conservative, moderate or aggressive. Then there are 4 different “time horizons” – fewer than 5 years to retirement, 5-10, 10-15 and more than 15. The participant is coached to “set it and forget it” except as his time horizon changes – and he is reminded of that quarterly. This creates a “grid” of 12 portfolios, or, "buckets" as we like to call them.

The buckets are constructed from 11 underlying funds, 8 of which are low-cost index funds. Our advisor uses low-cost actively managed funds for diversification when index funds are not available for a particular asset category.

If you're interested in learning more, click here to request a proposal from us!

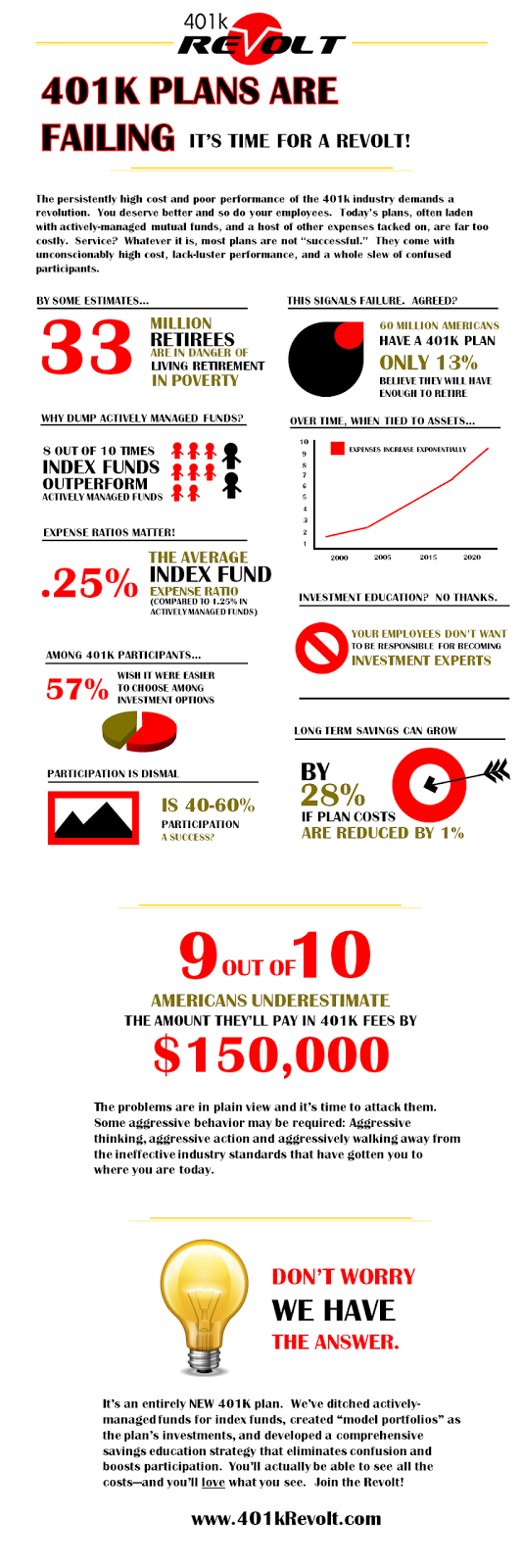

The persistently high cost and poor performance of the 401k industry demands a revolution. Today’s plans, comprised of actively-managed mutual funds, come with unconscionably high cost, lack-luster performance, and a whole slew of confused participants. We're on a mission to overthrow the 401K of the past. Our 401k plan results in low costs, high participation, and a savings education strategy that encourages participants to "set it and forget it."

Thursday, September 26, 2013

Monday, September 23, 2013

The Myth of the Active Advisor

I just read an interesting little article called Yesterday’sTop Mutual Funds in Today’s 401k Lineup.

I like the theme and one key point in particular caught my

attention: “Actually, no actively

managed fund stays on top forever”.

In fact, virtually no actively managed funds outperform their index with any regularity whatsoever! Decades of data and numerous empirical studies show that index funds, at approximately 1/5 the cost, outperform actively managed funds about 80% of the time. Not only that. Recent studies show that, more often than not, when active advisors recommend changes in funds, plan costs increase and the new fund does worse than the one it replaced! How could that be? Think about it. No one replaces a fund that’s doing well (so you are “selling low”) — and no one adds a fund that’s doing poorly (so you’re “buying high”). Is that not exactly the opposite of what conventional wisdom says you’re supposed to do? Is that not the very definition of “chasing returns”?

In fact, virtually no actively managed funds outperform their index with any regularity whatsoever! Decades of data and numerous empirical studies show that index funds, at approximately 1/5 the cost, outperform actively managed funds about 80% of the time. Not only that. Recent studies show that, more often than not, when active advisors recommend changes in funds, plan costs increase and the new fund does worse than the one it replaced! How could that be? Think about it. No one replaces a fund that’s doing well (so you are “selling low”) — and no one adds a fund that’s doing poorly (so you’re “buying high”). Is that not exactly the opposite of what conventional wisdom says you’re supposed to do? Is that not the very definition of “chasing returns”?

So your problem may not be that you don’t have an advisor. More likely, your problem is that you have an

advisor who told you to have actively managed funds in your plan and that he

now performs the admirable service of making periodic changes to find you

better ones. The data says that strategy fails with amazing frequency.

Everybody thinks their advisor is the exception to the data-proven rule, or you

wouldn’t have him around. But think about this: The fund your genius is telling

you to buy….someone else’s genius is telling them to sell.

Want to see how your actively managed funds are doing

against just the S&P index for example? Go to Yahoo Finance. You can readily check out your actively

managed funds, for any period of time, against an index. If you take the time

to do it, one of two things should happen: You dump your advisor and your

actively managed funds and join the 401k Revolt; or,

you insist that your advisor start taking you to places like the

Bahamas. Which one do you think is the best course for a plan fiduciary?

Friday, September 13, 2013

Subscribe to:

Comments (Atom)